Mortgage Rate Calculator Mortgages Halifax

The top three most popular mortgages are a fixed rate mortgage the interest rate is fixed for an agreed-upon set term of time a variable rate mortgage the interest rate is dictated by the prime rate with any changes reflecting on the principal not the fixed payments and an adjustable rate mortgage the interest rate is dictated by. Assuming the interest rate stays the same your monthly repayments will be 759.

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Insuran Mortgage Loan Calculator Fha Mortgage Mortgage Loan Originator

The mortgage repayment calculator can help you find a mortgage product to suit your requirements and calculate what your monthly repayments could be.

Mortgage rate calculator mortgages halifax. Mortgage rates continue close to record lows. An interest-only mortgage can make a mortgage more affordable but in this case it would mean that in 25 years time youd still owe the lender 200000. A mortgage of 113821 payable over 15 years and 2 months initially on a tracker rate for 2 years at 197 below the Royal Bank of Scotland base rate and then our variable rate of 359 for the remaining 13 years and 2 months would require 24 monthly payments of.

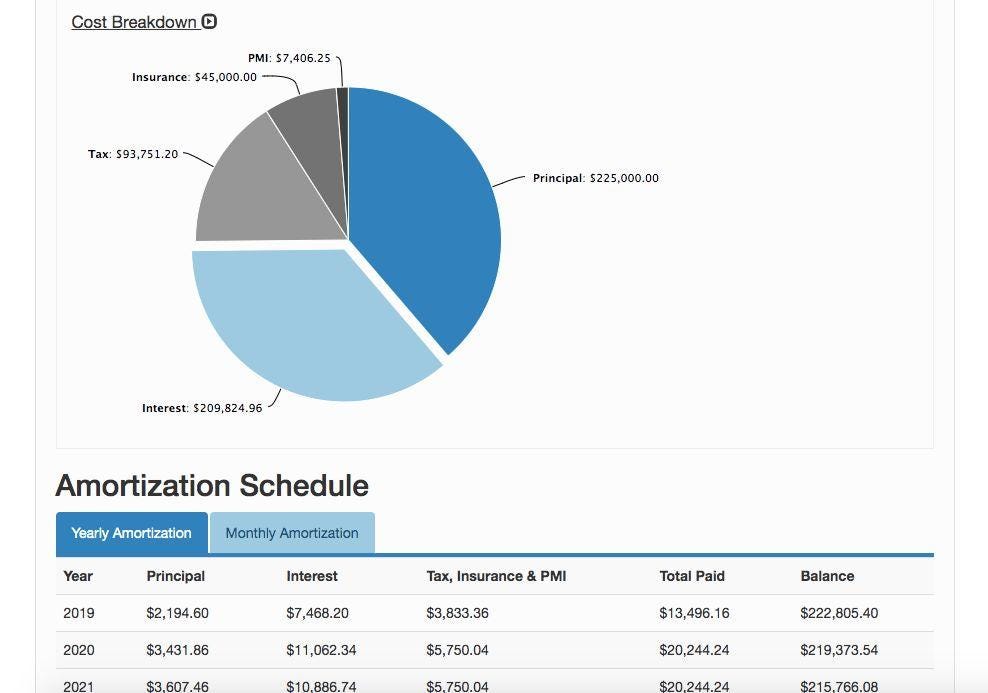

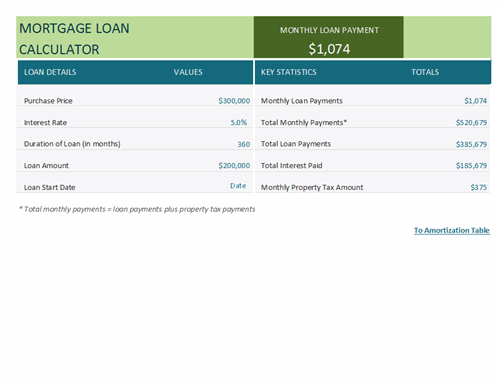

Shows the cost per month and the total cost over the life of the mortgage including fees interest. The average rate for a 30-year fixed mortgage is 313 the average rate for the benchmark 15-year fixed mortgage is. We take your inputs for home price mortgage rate loan term and downpayment and calculate the monthly payments you can expect to make towards principal and interest.

The maximum loan available may be impacted by the Loan to Value and may be lower than the amount displayed as a result of the limited information captured in the calculator. Lets say you borrow 160000 on a repayment basis over 25 years at an interest rate of 3. When using the repayments calculator bear in mind that the property price minus the deposit amount.

Halifax is a division of Bank of Scotland plc. Halifaxs mortgage calculator can help you get the best rates. The history of interest-only mortgages.

The loan is a 30-year fixed-rate mortgage at 35 APR. A 15-year loan went for 38. It has only been designed to give a useful general indication of costs.

This information is computer-generated and relies on certain assumptions. Back in 2010 the borrowing rate for a 30-year mortgage was 5. However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage balance.

The interest rate on 15-year mortgages is slightly better 225 but not a significant difference like it was 10 years ago. But not only were they approved their mortgage broker came through with a great offer on a variable-rate mortgage from Scotiabank. The total youd pay over the full term would amount to 227583 160000 mortgage debt 67583 total interest.

As the exact method of how this 10 is calculated varies by lender use our calculator as a rough guide and be sure to speak to. Whether this is a Fixed-rate or Variable mortgage. Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use.

As the names imply fixed rate mortgages give you an interest rate which is fixed for a set number of years and. Please note our affordability calculator is only for guidance purposes. Its important you always get a specific quote from.

To understand how this works lets take the example below. The 280000 loan had a 25-year amortization and a floating rate. This calculator determines how much your monthly payment will be for your mortgage.

The Mound Edinburgh EH1 1YZ. Accessibility statement Accesskey 0 Go to Accessibility statement. Halifax Intermediaries - tools calculators - affordability calculator.

Our tracker rate mortgages are linked to Bank of England bank rate also known as Bank of England repo rate. Registered in Scotland NoSC327000. The two key types of mortgage interest are fixed rate and variable rate mortgages.

This provides a ballpark estimate of the required minimum income to afford a home. Mortgage insurance Mortgage default insurance commonly referred to as CMHC insurance protects the lender in the case the borrower defaults on the mortgage. Suppose the house youre buying is priced at 325000.

Representative example A mortgage of 209101 payable over 23 years initially on a fixed rate until 300626 at 128 and then on a variable rate of 434 for the remaining 18 years would require 62 payments of 88463 and 214 payments of 112718. Find out how much your client will repay. If you paid the mortgage on a repayment basis youd owe the lender nothing and own the property outright at the end of the term.

Use our mortgage rate calculator to give you a quick idea of how much you could borrow show your mortgage rates and compare monthly payments. Fixed-rate mortgages generally come with a higher interest rate whilst a Variable mortgage will be lower with no guarantee of your interest rates not rising. Mortgage default insurance is required on all mortgages with down payments of less than 20 which are known as high ratio mortgages.

If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal. Before applying for a mortgage you can use our calculator above.

30 Year Mortgage Rates Chart Historical And Current Rates

If A Rep Is Asking You To Claim More Than You Make To Secure The Mortgage It 3 Home Loan Mortgage Claim Home Homeequityloan It3 Loan Mortgage Rep

Average Mortgage Calculate Average Mortgage Payment

Mortgage Calculator Excel 5 Mortgage Calculators Instantly Calculate Your Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Mortgage Mortgage Calc Mortgage Loans Mortgage Loan Officer Loan Officer

U K November Home Prices Fall As Halifax Flags Supply Shortage Mortgage Approval Initial Public Offering Being A Landlord

Jmblock Photography And Design Wix Com Mortgage Marketing Mortgage Payoff Mortgage Lenders

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Comparison Mortgage Loan Calculator Mortgage Amortization

Average Mortgage Calculate Average Mortgage Payment

Mortgage Calculator 10 Top Rated Websites To Calculate Mortgage Loan By Manoj Prasad Medium

Imagine An Entire Year With No Mortgage Payment Mortgage Payment Mortgage Loans Infographic

Halifax Mortgage Calculators Really Simplify The Mortgaging Task Mortgage Mortgage Lenders Calculator

Capapp Real Estate Android App Playslack Com Capapp Is A Real Estate Title Mobile App That Provides Easy Access To A Mob Mortgage Payment Mortgage Payment

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator In Mortgage Payment Calculator Mortgage Payment Mortgage Amortization

Comments

Post a Comment