Mortgage Backed Securities How They Work

Yields on the 10-year Treasury note hit an all-time low of 054 on March 9 2020 due to the global health crisis and they were inching back around 090 in December. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Three Reasons We Like Uk Residential Mortgage Backed Securities

These rates follow the yields on US.

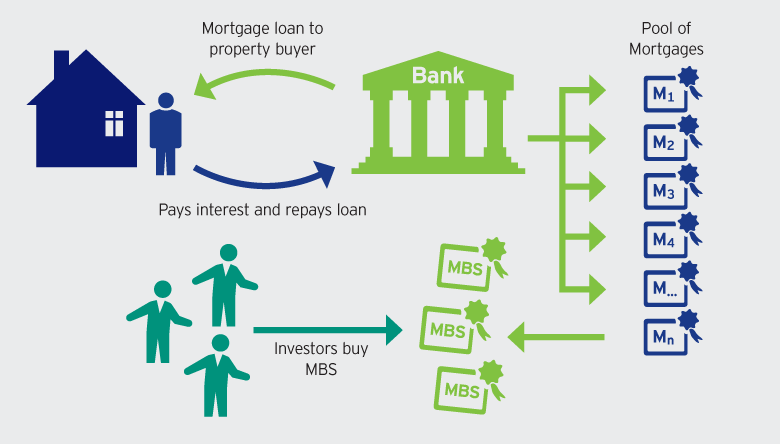

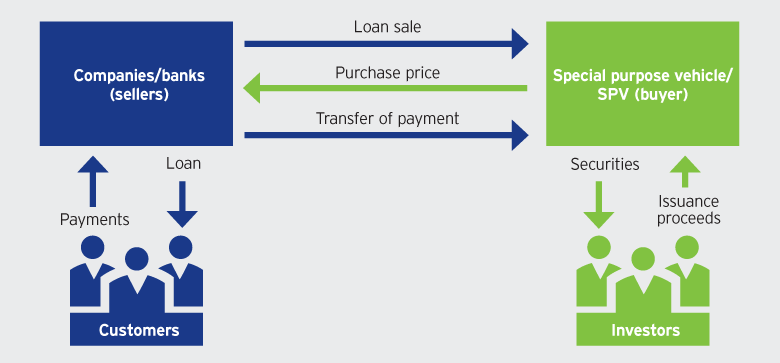

Mortgage backed securities how they work. That changed back in 2008 when the central bank began directly buying Mortgage-Backed Securities MBS and financing bonds offered by Fannie Mae and Freddie Mac. A form of securitization whereby single-family residential mortgages are swapped for mortgage-backed securities issued by government agencies such as Fannie Mae and Freddie. A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

A mortgage lender is an investor that lends money secured by a mortgage on real estate. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Banks create commercial mortgage-backed securities by taking a group of commercial real estate loans bundling them together and selling them in a securitized form as a series of bonds.

An MBS is an asset-backed security that is traded on the secondary market and that enables investors to profit from the mortgage business. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially granted. When they sell the mortgage they earn revenue called Service Release Premium.

Second mortgage types Lump sum. Typically the purpose of the loan is for the borrower to purchase that same real estate. They typically organize each series into tranches also called segments.

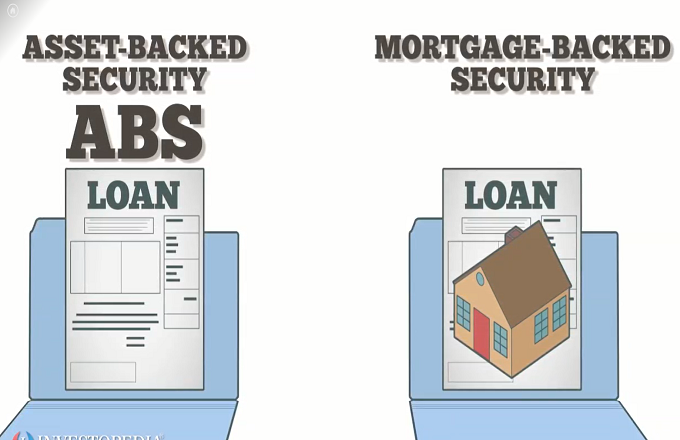

Fixed mortgage rates dropped to historic lows in December 2020 as investors fled to the safety of government securities. Asset-backed securities ABS and mortgage-backed securities MBS are two of the most important fixed-income assets but they can be very different. This liquefied mortgage markets giving investors a ready place to sell their holdings as needed helping to drive down mortgage.

In todays world most lenders sell the loans they write on the secondary mortgage market. Saudi Arabias state-backed mortgage refinancer expects to double or triple its balance sheet and begin issuing mortgage-backed securities in 2021.

Economist S View The Role Of Securitization In Mortgage Lending

/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

Securitized Banking Sociology Systems Research

Fixed Income Investing 2 Invesco Investmentcampus

How To Invest In Cmbs Commercial Mortgage Backed Securities Financeninsurance

:max_bytes(150000):strip_icc()/dotdash_Final_Why_do_MBS_mortgage-backed_securities_still_exist_if_they_created_so_much_trouble_in_2008_Apr_2020-01-fb17668872fd483781eef521a1ddbde8.jpg)

Why Do Mbs Mortgage Backed Securities Still Exist If They Created So Much Trouble In 2008

Simple Schematic Diagram Of Mortgage Lending And Securitization During Download Scientific Diagram

Asset Backed Security Abs Definition

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

What Are Mortgage Backed Securities Youtube

Us Mortgage Backed Securities An Oasis In The Desert Investors Corner

Understanding Securitisation Asset Backed Securities Abs

Securitized Banking Sociology Systems Research

Asset Backed Securities Abs Overview Securitization Benefits

A Complete Guide To Mortgage Reit Investing Money For The Rest Of Us

Commercial Mortgage Backed Securities Prepnuggets

Abs And Mbs Index Complete Beginner S Guide

Mortgage Backed Securities Mbs Finance Reference

Fixed Income Investing 2 Invesco Investmentcampus

Comments

Post a Comment